The challenges of a disembodied economy

Policymakers must reckon with a world in which companies invest in intangible assets

Martin Wolf

What is new about today’s economy? It is not the role of ideas themselves. The technologies we take for granted — the wheel, fired pottery, the plough or the steam engine — were once brilliant new ideas. What is new about today’s economy is that many of our best ideas remain disembodied. The idea is indeed valuable, but it does not take physical form. This changes almost everything.

That is the theme of an intriguing new book, Capitalism without Capital: The Rise of the Intangible Economy, by Jonathan Haskel of Imperial College and Stian Westlake of Nesta. Their main point is compelling: Apple, the world’s most valuable company, owns virtually no physical assets. It is its intangible assets — integration of design and software into a brand — that create value.

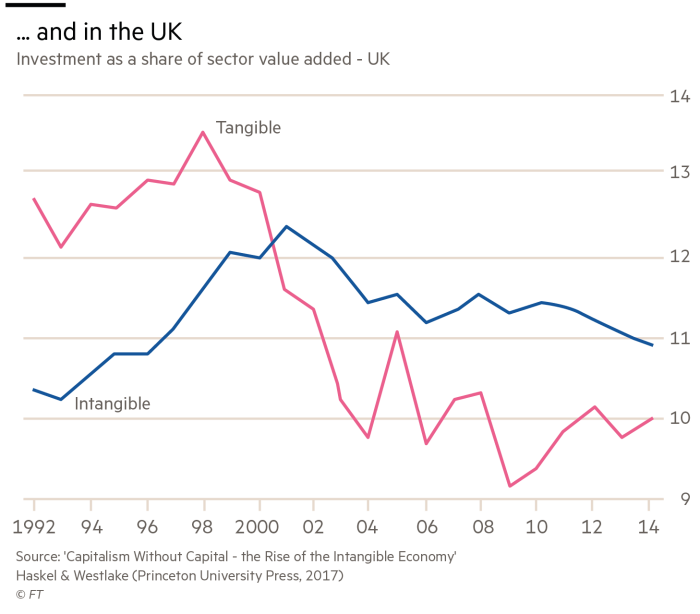

Perhaps the most surprising facts in a book full of surprises is how large investments in intangible assets — in research and development, software, databases, artistic creations, designs, branding and business processes — now are. Measuring this has become an important intellectual activity. In the US and UK, investment in intangible assets now exceeds that in tangible assets. This is also true in Sweden, but not in Germany, Italy or Spain. (See charts.)

This matters because the properties of intangibles are fundamentally different from those of tangibles. Understanding those differences may explain some of the peculiar features of the modern economy, including rising inequality and slowing productivity.

The authors explain the features of intangible assets by referring to the “four Ss”: scalability; sunkenness; spillovers; and synergies. Taken together, these subvert the familiar functioning of a competitive market economy.

“Scalability” means that an intangible good can be enjoyed by one person without depriving another of its benefits. Economists call such a good “non-rival”. You cannot eat the same sandwich as I can. But an intangible asset can be used over and over again. In an economy where scalability — frequently turbo-charged by network effects — is important, some businesses will quickly become huge. These winners may also enjoy huge incumbency advantages.

“Sunkenness” refers to the fact that intangible assets tend to have little or no market value, unlike, say, land or a factory. They have value as part of their owner’s business, but not to anybody else. This means that investment in intangible assets is risky. The fact that expectations are insecurely anchored might, argue the authors, also generate asset price bubbles.

“Spillovers” means that a large part of the benefits of an investment may accrue to others. Even with protection of intellectual property, much of the benefit of investment in an idea is likely to accrue to people other than the discoverers. Imitation (and theft) is a rewarding form of flattery. The presence of such spillovers weakens the incentive to invest. The answer is intellectual property rights, but these are inherently arbitrary and economically costly.

Finally, intangibles exhibit synergies. This goes against the spillovers. Synergies encourage inter-firm co-operation (or outright mergers), while spillovers are likely to discourage it. Who really wants to give a free lunch to competitors? Taken together, these features explain two other core features of the intangible economy: uncertainty and contestedness. The market economy ceases to function in the familiar ways.

Does the rise of intangibles explain what has come to be called “secular stagnation”? Partly.

This is not, it turns out, so much because growth has been underestimated. But a big issue is the growing gap in performance between leading companies and the laggards. The failure of the latter to benefit from investment in intangibles, by themselves or by others, may partly explain their weak growth in productivity.

Again, the rise in intangibles may also partly explain the increase in inequality. One way it can do so is that workers in the most successful businesses tend to share in their employers’ success.

Furthermore, people with relevant skills do outstandingly well. In addition and intriguingly, intangible-intensive businesses tend to cluster in thriving cities. This not only concentrates opportunity, but raises property values, spreading wealth to those who own these properties.

Finally, intangible assets are mobile, which makes them hard to tax.

This transformation of the economy demands a rethink of public policy. Here are five challenges. First, frameworks for protection of intellectual property are more important. But this definitely does not mean these protections must be still friendlier to the owners of such property. Intellectual property monopolies may indeed be necessary, but, like all monopolies, they can be costly. Second, since synergies are so important, policymakers need to consider how to encourage them, including via policies on telecommunications and urban development.

Third, financing intangibles is hard. For traditional collateral-backed bank lending, it is almost impossible. The financial system will need to change. Fourth, the difficulty of appropriating gains from investment in intangibles might create chronic under-investment in a market economy. Government will have to play an important role in sharing the risks. Finally, governments must also consider how to tackle the inequalities created by intangibles, one of which (insufficiently emphasised in this book) is the rise of super-dominant companies.

Messrs Haskel and Westlake have mapped the economics of a challenging new economy. It is a world in which many of the old rules do badly. We need to reimagine policy, carefully.

0 comments:

Publicar un comentario